irs income tax rates 2022

IRS provides various prescribed rates for income tax purposes. Each month the IRS provides various prescribed rates for federal income tax purposes.

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

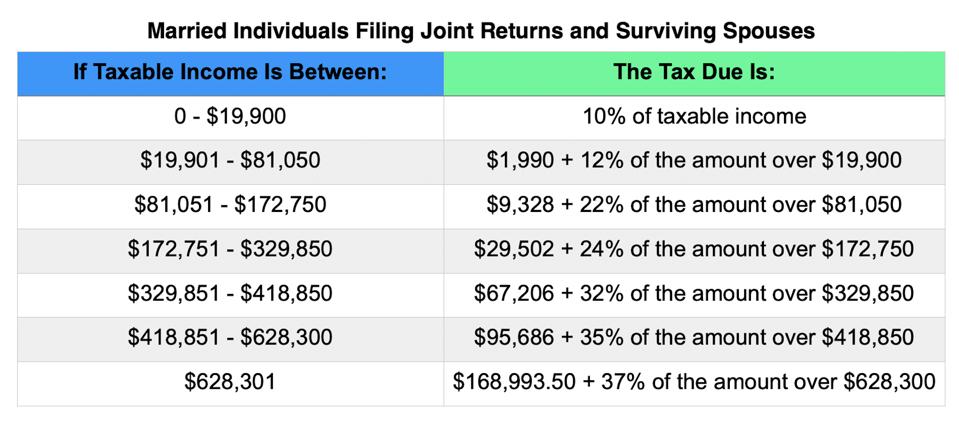

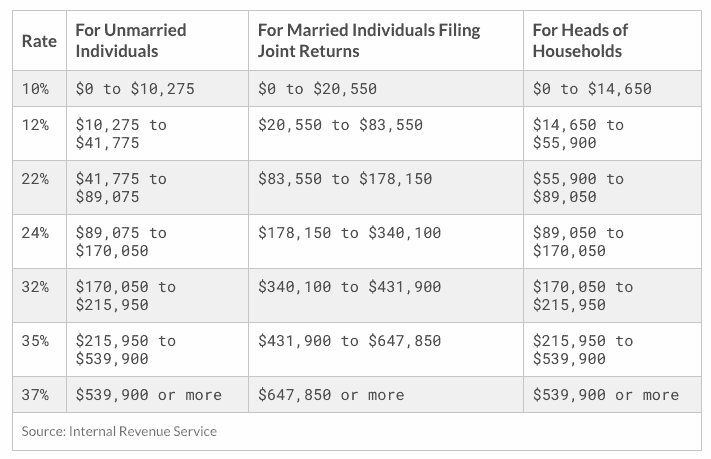

Whether you are single a head of household married.

. For singles and couples filing separately it will rise to 13850. The United States Internal Revenue Service uses a tax bracket system. Below are the new brackets for both individuals and married coupled filing a joint return.

10 12 22 24 32 35 and 37. The tax rate increases as the level of taxable income increases. 862022 For 2022 LLCs filing as an S corporation must file Form 1120S by March 15 without an extension.

Accordingly the inflation-adjusted tax rate imposed on motor fuel under the MFTA for the tax period beginning January 1 2022 through December 31 2022 is 272 cents-per-gallon 263. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the. The 2022 tax rate ranges from 10 to.

Your bracket depends on your taxable income and filing status. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Explore updated credits deductions and exemptions including the standard deduction.

There are seven federal tax brackets for the 2021 tax year. 35 for incomes over 215950 431900 for. Every year the Internal Revenue Service IRS adjusts income tax brackets based on inflation.

For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. IRS Advisory Statement December 27 2107 Metuchen Borough Hall 500 Main Street Metuchen NJ 08840 732-632-8540 Powered by Zumu Software Do more with your website. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

2022 Tax Brackets Irs Calculator. Use it for the business portion of the first 14000 kilometres. Mm2 codes 2022 not expired june.

These are the rates for. Heres how single and joint filers will be taxed for 2022. Federal Income Tax Brackets 2022.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. The table of rates for the 2021-2022 income year The Tier 1 rate is a combination of your vehicles fixed and running costs.

Since a composite return is a combination of various individuals various. The IRS recently released the new inflation adjusted 2022 tax brackets and rates. These rates known as.

The average individual income tax rate was nearly unchanged. The 19 million taxpayers who requested an extension on the april deadline have until oct. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. 6 hours agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said. Millions of americans are racing to file their 2021.

1329 percent in 2019 compared to 1328 percent in 2018. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. Even though the IRS pushed back the tax filing deadline its still a good.

Like us on Facebook to. 2 hours agoFor a married couple filing a joint tax return that deduction will jump to 27700 in 2023 from 25900 in 2022.

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

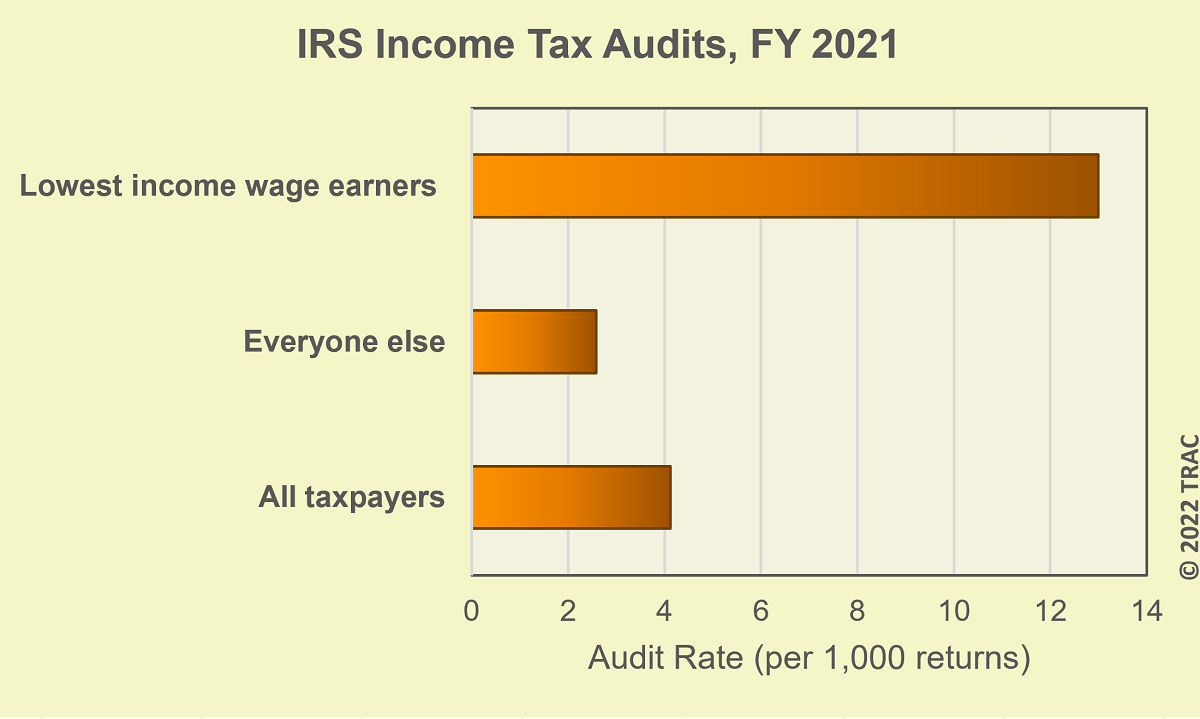

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Federal Income Back Taxes Income Tax Rates And Brackets

2021 2022 Tax Brackets And Federal Income Tax Rates

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Understanding Marginal Income Tax Brackets Gentz Financial Services

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Us Tax Changes For 2015 Us Tax Financial Services

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What Is The Difference Between The Statutory And Effective Tax Rate

2022 Tax Tables Tax Brackets Standard Deductions Credits Ally

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More